What if the IRS’s power to enforce its rules was diminishing? A recent Supreme Court ruling might significantly alter how agencies like the IRS exercise their authority. For Portland business owners, this shift could create new opportunities to protect hard-earned money and reduce tax liabilities.

Categories

Tags

Blog tagged as IRS Auditing

The IRS’s Power May Be Weakening: What the Supreme Court's Latest Decision Means for Your Taxes

By Daveed

Comment(s)

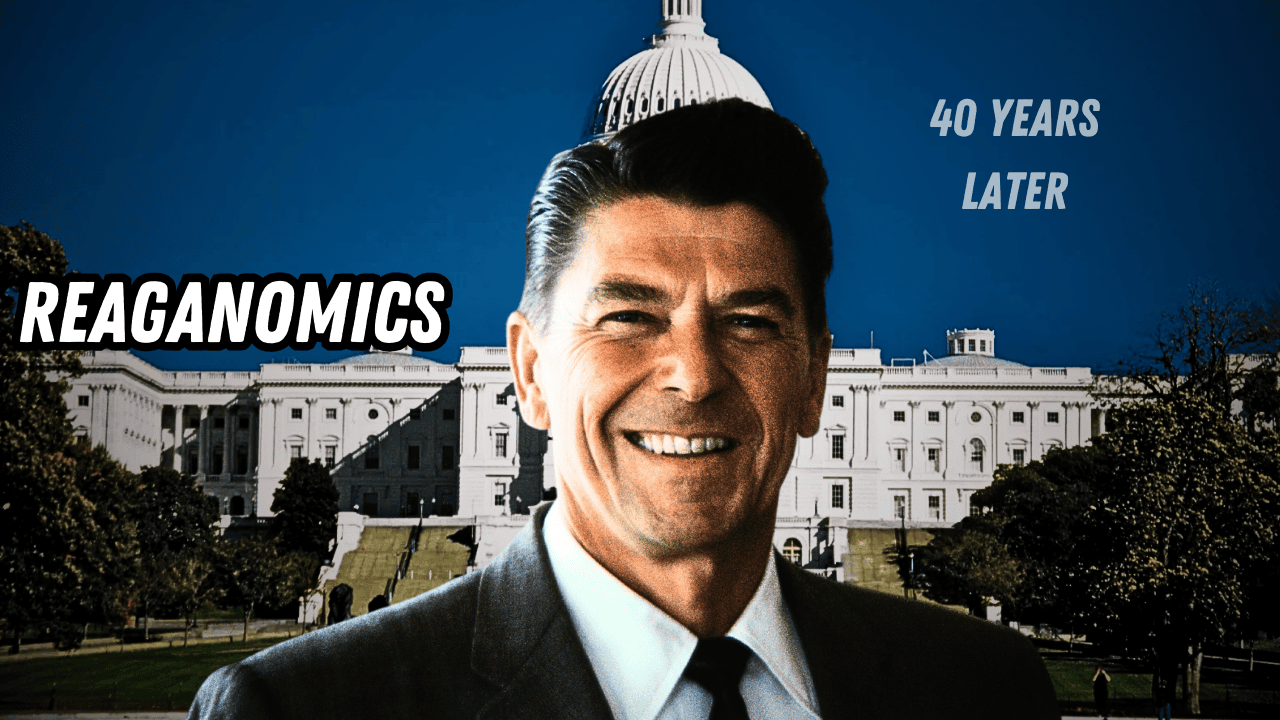

The economic landscape has seen monumental shifts over the past four decades, largely influenced by policy reforms initiated during the Reagan administration. Known as Reaganomics, these policies fundamentally reshaped the tax environment, giving businesses and indivi...

“Federal Income Taxation” is the foundational tax class in any accounting or law school program. Contrary to what you may think, it doesn’t involve diving into thickets of dense, impenetrable tax forms or long, intimidating columns of numbers. The final exam doesn’t challenge students to fill out a ...

A rookie NFL quarterback tried to save on taxes by asking to be paid through an LLC as an independent contractor, hoping to avoid millions in taxes. However, the NFL blocked the idea due to its collective bargaining agreement. The story highlights the importance of tax planning for athletes.

Becoming the first Main Street Certified Tax Advisor in Oregon is an exciting milestone. I encourage other professionals to explore this program and join me in transforming the future of tax planning.